For companies, a capital asset is an asset with a helpful life longer than a 12 months that is not supposed on the market in the common course of the business’s operation. For example, if one firm buys a computer to use in its office, the pc is a capital asset.

How do you calculate plant assets?

Current assets include items such as cash, accounts receivable, and inventory. Noncurrent assets are always classified on the balance sheet under one of the following headings: investment; property, plant, and equipment; intangible assets; or other assets.

If one other company buys the same computer to promote, it’s considered stock. The improve in depreciation arising out of revaluation of fixed property is debited to revaluation reserve and the traditional depreciation to Profit and Loss account. The United Kingdom, Australia, and India permit upward revaluation in the values of mounted assets to bring them in consonance with honest market values.

Individuals maintain capital and capital belongings as a part of their net worth. How individuals and companies https://cex.io/ finance their working capital and invest their obtained capital is crucial for development and return on funding.

What are the 4 types of capital?

Current assets are the assets which are converted into cash within a period of 12 months. Current liabilities on the other hand are the liabilities to be discharged or disposed off within a period of a year. Current liabilities are Sundry Creditors, Short terms loans and bank overdraft, Outstanding expenses etc.

If a company needs to sell one of its assets, it is revalued in preparation for sales negotiations. Just as with our free cash circulate calculation above, you’ll wish to have your steadiness sheet and income statement on the ready, so you possibly can pull the numbers involved in the operating money circulate method. Neville Enterprises has a number of fully depreciated assets which are still being utilized in the main operations of the enterprise.

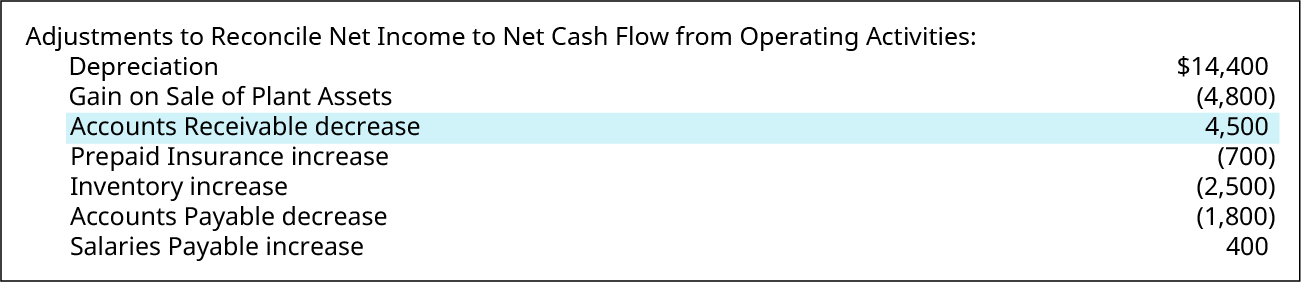

Profit, nevertheless, is the money you could have after deducting your corporation expenses from overall income. Both are important, but cash flow is important to maintain your business working in the here and now. Free cash circulate represents the cash a company can generate after accounting for capital expenditures needed to take care of or maximize its asset base. The cash circulate assertion must then reconcile net income to net cash flows by including back non-money expenses such as depreciation and amortization.

However, the regulation requires disclosure of the idea of revaluation, quantity of revaluation made to every class of property (for a specified interval after the monetary yr during which revaluation is made), and different info. Similarly, the legislation prohibits payment of dividend out of any reserve created as a result of the upward revaluation of mounted belongings. To conserve sufficient funds within the business for replacement of mounted property on the end of their helpful lives.

Given the chance value of fairness, an organization can have constructive net income however negative residual earnings. Cash circulate refers back to the money that flows in and out of your small business.

Similar changes are made for non-cash expenses or revenue corresponding to share-based compensation or unrealized gains from overseas https://www.binance.com/ currency translation. Another contra asset account is Allowance for Doubtful Accounts. This account seems subsequent to the current asset Accounts Receivable.

Provision for depreciation primarily based on historic price will present inflated profits and result in cost of excessive dividends. The objective of a revaluation is to bring into the books the fair market worth of fastened property. This could also be useful so as to determine whether to spend money on one other business.

Residual income is calculated as net revenue much less a charge for the cost of capital. The charge is known as the equity charge and is calculated as the worth of fairness capital multiplied by the cost of fairness or the required rate of return on fairness.

Noncurrent Assets

- To initially fund a petty money account, the accountant should write a examine made out to “Petty Cash” for the desired amount of money to maintain readily available and then cash the check on the firm’s bank.

- When petty money is used for business bills, the suitable expense account — corresponding to workplace supplies or employee reimbursement — must be expensed.

- Split between property, liabilities, and fairness, an organization’s steadiness sheet supplies for metric analysis of a capital construction.

- Balance sheet evaluation is central to the evaluation and assessment of enterprise capital.

- The journal entry on the balance sheet should listing a debit to the enterprise bank account and a credit to the petty money account.

- Businesses want a considerable quantity of capital to function and create worthwhile returns.

Name the gadgets, along with the amount paid to the previous owner or contractor, that may properly be included as part of the acquisition value of the next plant belongings. This guide will train you to perform monetary statement analysis of the revenue assertion, stability https://cryptolisting.org/ sheet, and cash circulate statement together with margins, ratios, development, liquiditiy, leverage, charges of return and profitability. Property, plant, and tools (PP&E) are lengthy-time period property vital to business operations and never easily transformed into money.

The price for capital belongings may include transportation prices, set up costs, and insurance costs associated to the bought asset. If a agency bought machinery for $500,000 and incurred transportation expenses of $10,000 and set up prices of $7,500, the cost of the machinery might be recognized at $517,500. Capital assets are vital pieces of property similar to homes, cars, investment properties, stocks, bonds, and even collectibles or art.

Companies that use the accrual methodology of accounting report wages expense as the fee is incurred, which isn’t essentially when the company pays the employee. A debit to this account, under the accrual foundation, requires a credit to the wages payable account for any quantities not paid. Many firms, and all publicly traded corporations, use the accrual foundation of accounting to maintain observe of and record revenue and bills. Unlike cash basis accounting, which information bills when the company pays for them, the accrual technique data them when the corporate earns the revenue or incurs the expense. This causes a big difference in wages expense and is the underlying reason for the wages payable account in these companies.

Is laptop a fixed asset?

Salary is an income because it adds money to your pocket. It is possible though, for your salary to become an asset — by investing it. But it is not a liability.

Wages expense is the account that the bookkeeper or accountant uses to record the labor prices of the company. You can also check with it as wage expense or payroll expense, depending what are net plant assets on the organization’s desire. Those businesses that use the cash basis of accounting record this expense as it is paid to the workers.

The Difference Between An Operating Expense Vs. A Capital Expense

Purchases of PP&E are a sign that management has faith within the long-term outlook and profitability of its company. A plant asset is an asset with a helpful life of multiple year that is used in producing revenues in a enterprise’s operations. Retained earnings check with the online earnings of an organization from its beginnings up to the date the balance sheet is structured. For companies with multiple stockholders, any declared dividends are subtracted to acquire the retained earnings determine.

The account Allowance for Doubtful Account is credited when the account Bad Debts Expense is debited beneath the allowance technique. The use of Allowance for Doubtful Accounts allows us to see in Accounts Receivable the total amount that the corporate has a proper to gather from its credit score prospects. The credit score stability within the account Allowance for Doubtful Accounts tells us how much of the debit stability in Accounts Receivable is unlikely to be collected. On an organization’s stability sheet, retained earnings or amassed deficit balance is reported in the stockholders’ fairness part. Stockholders’ fairness is the quantity of capital given to a enterprise by its shareholders, plus donated capital and earnings generated by the operations of the enterprise, minus any dividends issued.

Accumulated retained earnings are the income firms amass over time and use to foster progress. Adjust the accounts to replicate the group https://cryptolisting.org/blog/what-are-plant-assets‘s appropriate monetary place when errors occur in the accounts in subsequent intervals.

Revenues and features are recorded in accounts corresponding to Sales, Service Revenues, Interest Revenues (or Interest Income), and Gain on Sale of Assets. These accounts usually have credit https://beaxy.com/ score balances which are increased with a credit score entry. In a T-account, their balances might be on the right facet.

Because the belongings are absolutely depreciated, the president of the corporate decides to not show them on the steadiness sheet or disclose this data within the notes. (b) Machinery and equipment prices may properly include freight and dealing with, taxes on buy, insurance coverage in transit, installation, and bills of testing and breaking-in. (c) If a constructing is purchased, all restore costs, alterations, and enhancements essential to prepared the building for its meant use should be included as part of the acquisition cost.

What Is Cash Flow?

Residual income valuation fashions contemplate all of the cash flows that accrue to the firm post the cost to suppliers and different outdoors parties. The value of the corporate is the sum of book worth and the current worth of expected future residual income.