If you are searching to buy yet another vehicle, you will need to start thinking about funding solutions before day. That is where credit rating will get essential if you are planning in order to finance having that loan otherwise lease. Loan providers and dealerships commonly look at the credit score and you can credit history to assess the amount of exposure they’d need bear. Keep in mind, he could be getting a threat every time they accept that loan or book. Thus, it’s only natural so they can measure the financing dangers – increasingly cause of one to tune in to your credit score.

To understand what credit history must get a car, you should basic determine extent you need to use and you may the lending company. For each and every financial can get additional credit terms and conditions and you may principles. Most are more strict than others and certainly will demand a top score.

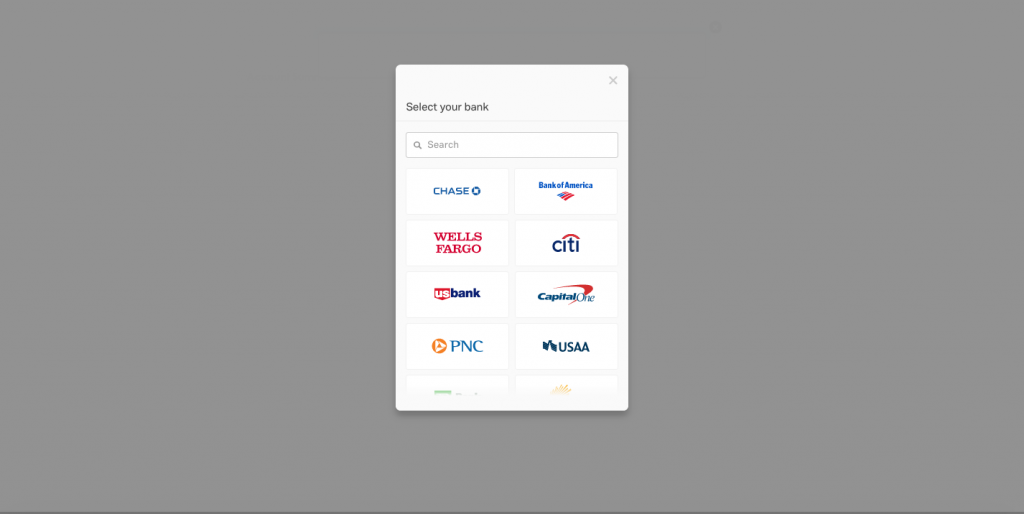

The better your credit report indicators to the lender a higher likelihood of curing this new financed count. You are able to Chase Borrowing from the bank Travel to look at the VantageScore credit rating free of charge. You are as well as eligible to a free of charge yearly credit file of annualcreditreport, a 3rd party website for free credit reports.

To you personally, good credit rating can convert so you can a far greater chance of being qualified to have financial support. And you may a higher credit rating might get you usage of lower rates of interest, monthly obligations, and more identity alternatives.

This is exactly a question you to definitely weighs in at into many vehicle consumers having reduced credit scores or no credit rating anyway. No matter if in the long run it’s a good idea to make use of devices eg Chase Borrowing Go to help you make your borrowing from the bank health.

There are various lenders just who bring financing to these kind of people. However, because this class offers highest credit dangers, funding will come that have certain restrictions.

Instance, the latest acknowledged investment amount would be notably down to own individuals with zero credit score. Nevertheless they may come that have reduced favorable payment terms and conditions and better interest rates. This could increase the total cost out-of borrowing. And also the approval processes could be more state-of-the-art that will require extra evidence of ability to pay off.

If you’re looking to buy a vehicle but never provides higher credit, here are some ideas to help you.

Consider your entire choice

In lieu of race on the resource, purchase enough time to research the various other borrowing from the bank available options so you’re able to you. Identify loan providers whom render investment institution to have individuals having borrowing such both you and evaluate their lending requirements, credit score conditions, and terms. Some loan providers might have highest interest rates, deciding to make the repayment difficult to manage with present monetary commitments. Otherwise they might enjoys lending requirements you are incapable of meet right now. Thus, carefully contrast and make sure you read the small print just before shortlisting the best selection.

Create more substantial downpayment

A bigger deposit can be lower your borrowing from the bank specifications. This can enhance the danger of acceptance because it signals good lower chance to your lender. It will slow down the complete credit costs such as for instance interest costs. So, protecting upwards for a down-payment before wanting automobiles you’ll build a lot of experience, especially if you happen to be confronted with a dismal credit score.

Pick a co-signer

An excellent co-signer having a good credit score provides an additional guarantee for the lender with respect to relieving their money. A co-signer try an individual who applies to own capital which have another person and you Reading took out a payday loan will legitimately agrees to settle their financial obligation in case your top borrower does not work out to really make the costs. That it lowers the risk of credit, it is therefore probably be might agree the program.

Manage your requirement

When you yourself have the lowest credit score, the possibilities of credit will compress as a result of the highest credit threats in it. This kind of activities, there are lots of things that can help you, such as for instance boosting your credit score, to increase the odds of going accepted.

For borrowers who are in need of to alter the credit rating, you might have to opt for a less expensive vehicles. Becoming practical on which you really can afford and you may handling your bank account is a sensible idea given interest rates while the total cost out-of credit also.

Help make your credit rating

Finding the time to alter your credit rating is obviously a beneficial better option in the long term. This means you’re going to have to begin planning ahead that can even have to help you impede the purchase off a unique vehicle. However, strengthening the credit you are going to improve your ability to safe borrowing from the bank having greatest rates of interest and you can terms and conditions. A top rating also can replace your possibility of securing an effective large borrowing number.

Paying off handmade cards, paying off delinquent financial obligation, and you may to make into the-big date bill repayments can all of the let improve your credit history more big date. And make sure your closely tune your credit status which have a beneficial device instance Pursue Borrowing from the bank Excursion.

Boosting your credit rating is likely in your best interest. Individuals that have good credit normally have much more alternatives and receive most readily useful costs and words, and it may be a lot much easier once you analysis research and you may prepare yourself beforehand.